The struggle against the COVID-19 virus took another turn on September 9, 2021, when President Biden declared that he was issuing an executive order that would require more working Americans to become vaccinated or be subjected to at least one weekly virus test. This initiative is part of his six-pronged Path out of the Pandemic action plan and this specific prong is targeted at private companies that have 100 or more employees.

When will this declaration take effect? The President’s announcement has no immediate impact on employers because the regulatory infrastructure does not yet exist. OSHA has been selected as the agency to enforce the order using its Emergency Temporary Standard (ETS) authority. An ETS is a short-term regulation that the agency uses to address any immediate threats to the health and safety of workers.

On September 10th, OSHA’s parent organization, the Department of Labor, briefed the press regarding the matter at which point it was clear that the ETS process would take months to complete. It is also likely that legal challenges to it will be immediate from those factions that oppose COVID-19 vaccinations as a condition of employment or for other reasons.

While it is uncertain how the courts will rule on the legality of this specific ETS, the vast majority to date have refused to overturn vaccine mandates. It is likely that the judicial process will be lengthy and therefore delay its implementation for an extended time-period so some employers may consider taking a “wait and see” attitude until more information becomes available. Other employers, however, who have been hesitant to adopt a mandatory vaccination and testing policy may choose to use the president’s declaration as justification or as “political cover” to implement a test or vaccination program.

Below are some details of the President’s and the Department of Labor’s announcements:

- Those employees who decide to become vaccinated must be afforded paid leave to do so. Through September 30,2021 (at least), companies with fewer than 500 employees can obtain a tax credit for costs associated with this requirement under the American Rescue Plan Act.

- The 100-employee threshold is based on the total number of employees, not by location.

- Fines proposed for non-compliance with the ETS will be up to $14,000 per violation

- No definition has been provided of what being “vaccinated” really means. Is one shot sufficient, or must the employee have the second shot too? What about booster shots? Does OSHA expect employers to keep vaccination and testing records and, if so, how?

- Will the agency respond only to complaints, or will vaccination checks be part of a special emphasis program?

At this point, there are more questions than answers about this executive order. Once OSHA releases its ETS (and that could take months), companies with over 100 employees will have a better idea what to expect. Even then, immediate legal challenges and subsequent court rulings may modify, or even overturn it. Suffice to say that the future of this initiative is uncertain. In the meantime, employers should check the OSHA website periodically to see if the agency has posted any new information regarding this ETS.

Preventing Workplace Hearing Loss Requires Attention

Hearing loss among workers is common in the United States; some 12% of employed Americans suffer from the disorder and 24% of this group developed the condition because of their work environments. In addition, about 8% have tinnitus (also known as “ringing in the ears”) and 4% have both hearing loss and tinnitus. Noisy surroundings degrade a worker’s ability to hear gradually over years, even decades, of exposure, so it is important for employers to continuously evaluate their workers and jobsites to identify conditions that may lead to hearing damage.

OSHA requires that employers provide “a safe and healthful workplace” so hearing loss prevention is no different from any other safety precaution and must not be overlooked or ignored. OSHA also expects employers to implement a hearing conservation program when noise exposure is time-weighted average (TWA) at or above 85 decibels (dBA) averaged over 8 working hours, or an 8-hour TWA.

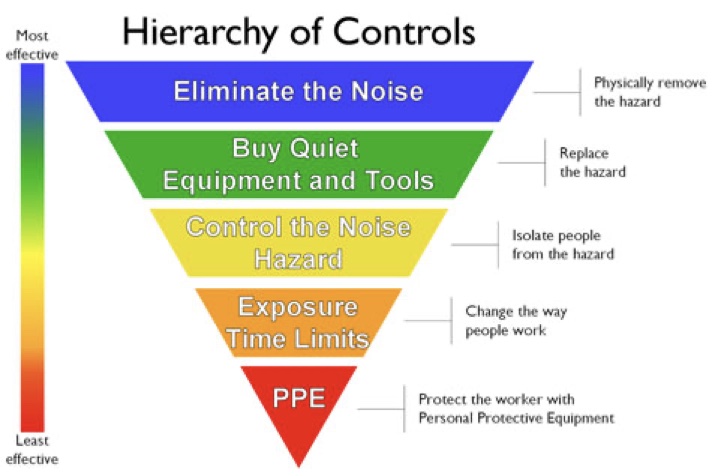

The agency provides employers with some guidance to help them to understand how to implement a hearing preservation program for exposures above the 85 dBA threshold. It suggests that they use its Hierarchy of Controls inverted pyramid for hearing loss prevention (see below). This graphic illustrates the general concepts and strategies to help protect workers’ hearing, in descending order from most to least effective:

Elimination Or Substitution: Generally, eliminating the source of hazardous noise is the most desirable tactic. When this is not possible, substitution is the next best alternative such as replacing loud equipment or tools with quieter versions whenever possible.

Engineering and Administrative Controls: Engineering controls require physical changes to the workplace. For example, constructing sound barriers to protect workers or redesigning equipment to eliminate or reduce noise sources. If engineering controls are not feasible, employers may adopt administrative controls. These include strategies such as modifying shift schedules to minimize worker exposure to noise, providing quiet lunch and break areas, operating high noise producing machines during shifts that have the fewest number of employees…etc.

Personal Protective Equipment (PPE): Whenever the noise source is impossible or impractical to manage successfully using the top four methods listed above, employers must resort to using the least effective control, personal protective equipment (PPE). OSHA’s instructions for employers using PPE are codified in the following sections of 29 CFR Part 1926:

- 1926.101(a) Wherever it is not feasible to reduce the noise levels or duration of exposures to those specified in Table D-2, Permissible Noise Exposures, in 1926.52, ear protective devices shall be provided and used.

- 1926.101(b) Ear protective devices in the ear shall be fitted or determined individually by competent persons.

- 1926.101(c) Plain cotton is not an acceptable protective device.

Table D-2 mentioned above is an important reference tool for employers because it sets the permissible exposure limits (PELS) for noise using duration of exposure (hours per day) and decibel (dBA) levels. In general, the table requires that, as noise levels increase, the permitted time of exposure to the noise must decrease.

| Table D-2. — Permissible Noise Exposures | |

| Duration per day, hours | Sound level DBA slow response |

| 8 6 4 3 2 1½ 1 ½ ¼ or less | 90 92 95 97 100 102 105 110 115 |

OSHA, however, permits hearing loss caused by the work environment to be distinguishable from hearing loss associated with employee lifestyles or behavior. It states that The OSHA Recordkeeping Regulation allows hearing an employer to seek and consider the guidance of a physician or licensed health care professional when determining the work-relatedness of any worker injury or illness case. Section 1904.10(b)(6) emphasizes the fact that an employer may consider an employee’s hearing loss case to be non work-related if a physician or other licensed health care professional determines the hearing loss is not work-related under section 1904.5.

Hearing loss is an insidious, debilitating, and irreversible condition but preventing it sometimes has been overlooked or its impact underestimated. Employers and safety professionals alike are charged with providing a hazard-free working environment, which also includes protecting employees from potentially damaging noise levels. For more information and additional guidance, visit the OSHA website at https://www.osha.gov/noise

_____________________________________________________________________________________

Governor Hochul Signs New Wage Theft Legislation

New Bill Holds General Contractors Liable for Unpaid Wages by

SubContractors

On September 6th, Governor Hochul signed A.3350-A/S.2766-C which makes contractors liable for wages owed to employees of their subcontractors. The bill’s summary read as follows:

“Provides that a contractor making or taking a construction contract shall assume liability for any debt resulting from making a wage claim, owed to a wage claimant or third party on the wage claimant’s behalf, incurred by a subcontractor at any tier acting under, by, or for the contractor for the wage claimant’s performance of labor; provides for wage theft prevention and enforcement.”

You can read the entire text of the bill here

Please direct any questions or concerns to:

The Safety Division at Hamond Safety Management

Anthony Vacchio, avacchio@hamondgroup.com